New Features in LA Pay: Enhanced Security and Customization with a Focus on AVS/CVV and Address Verification

We’re excited to share the latest updates to LA Pay centered around AVS and CVV verification. These updates result from operator feedback on LA Pay. Limo Anywhere has worked directly with the card brands to provide our customers with an improved experience and flexibility.

Understanding AVS/CVV and Address Verification

AVS (Address Verification Service) and CVV (Card Verification Value) are essential security features in electronic credit card transactions to reduce fraud.

- AVS compares the billing address provided by the card user with the address on file at the credit card company. This is particularly important for verifying online and other card-not-present transactions.

- CVV is the 3-4 digit number found on your card, adding an extra layer of security. It is used to verify that the cardholder has the physical card in their possession during non-face-to-face transactions.

Together, these systems provide a robust framework to safeguard against unauthorized credit card use, ensuring that transactions are legitimate and secure.

Enhanced Card Validation: Automatic Authorization Hold

We are introducing an improved card validation process in LA Pay to enhance security and transaction success rates.

Automatic Authorization for New Cards:

- When a new card is added to LA Pay, a temporary $1.00 authorization hold is automatically processed to verify the card’s validity.

- Seamless Process: No action is required from you to release this authorization. It will be removed automatically shortly after it’s processed.

- Visibility: While this authorization won’t appear in the LA payment terminals, it can be viewed in MerchantTrack.

Note on Hold Duration:

- The duration of this hold might vary based on the card network and issuer. We request the auto-authorization to be lifted within minutes, but this timing can differ depending on external factors.

Applicability:

- This automatic authorization is applied to every new card added to an LA Pay gateway intended for future use (e.g., adding to a trip or an account). It’s a default feature designed to increase the success rate of future transactions with that card.

- Exception: If a card is entered directly into a payment terminal for immediate charging, this automatic authorization process will not occur.

This update aims to streamline your experience with LA Pay, ensuring that every card added is quickly validated for future transactions, thus reducing potential issues.

Enhanced Security Settings for Card Addition in LA Pay

To give you more control and align with your risk tolerance, we’ve updated the security settings for adding new credit cards in LA Pay.

Customizable Verification Settings:

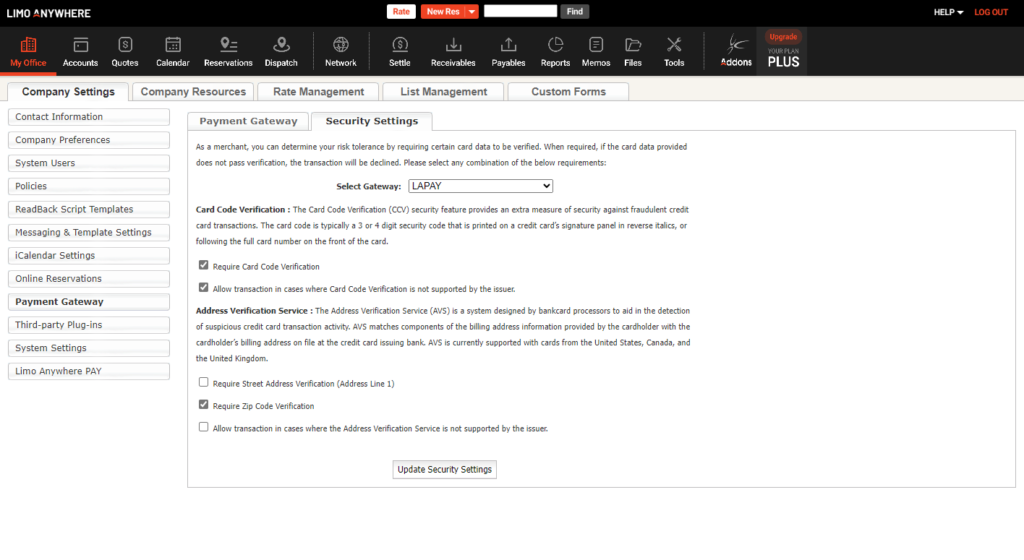

- Located at: My Office --> Company Settings --> Payment Gateway --> Security Settings.

- You can now set your preferences for verifying a combination of security code and address details. This ensures that when a new card is provided, it must meet your specified requirements to be successfully added or processed.

Address Verification Settings

- Require Street Address Verification (Address Line 1): This setting checks the street/building number part of the address. When enabled, Address Line 1 becomes a required field for card addition.

- Require Zip Code Verification: Ensures the Zip Code matches the card’s registered address.

- Allow Transactions without AVS Support: Even if the issuer doesn’t support address verification, the card can still be added, accommodating cases where cards lack AVS capability.

Card Code Verification Settings

- Require Card Code Verification: Prevents card addition if the 3-4 digit CVV is incorrect.

- Allow Transactions without CVV Support: This option permits adding cards that do not have CVV verification, enhancing flexibility.

Expanded Error Messaging for Payment Terminals

Payment terminals have been upgraded to provide detailed error messages, especially for 1020 errors. This feature allows you to understand immediately why a transaction was declined, such as due to a mismatch in address or CVV, directly in the terminal.

Uniform Application of New AVS/CVV & Address Rules

We’ve applied these new AVS/CVV & Address rules across all platforms, including LA Core, PWA, ORES, Payment Request, and the Quote Conversion Screen, ensuring consistency in security checks.

Settings Overview:

- PWA, ORES, Payment Request:

- With ‘Require Street Address’ enabled, the extent of billing details required varies based on your settings.

- LA Web:

- Billing information requirements are dependent on your ‘Street Address Check’ settings.

- DriverAnywhere & Limo Anywhere Mobile:

- Address Line 1 becomes mandatory for LA PAY credit cards when ‘Street Address Check’ is enabled.

Looking Ahead

These updates are part of our ongoing commitment to enhancing security and customization for your payment processing needs. We appreciate your continued partnership and look forward to making further advancements.

Thank you for choosing Limo Anywhere!